Solar Panels: Do They Help or Hurt Your Home Sale?

In today’s eco-conscious world, solar panels are more than just a trend—they’re a statement. But when it comes to selling your home, do these shiny rooftop additions help or hurt your chances? The answer isn’t as black and white as you might think. Let’s dive into the real impact of solar panels on home sales in 2025, backed by the latest data, expert opinions, and real estate trends.

1. The Rise of Solar Energy in Residential Real Estate

Over the past decade, solar energy has transitioned from a niche market to a mainstream home upgrade. With rising electricity costs, increasing environmental awareness, and generous government incentives, more homeowners are turning to solar as a smart investment.

According to SolarReviews’ 2025 study, homes with solar panels sold for 6.9% more on average than homes without them

2. The Pros: How Solar Panels Can Help Your Home Sale

Higher Resale Value

Buyers are increasingly willing to pay a premium for homes with solar panels. Why? Because they’re buying into long-term savings on energy bills and a greener lifestyle.

Faster Sales

Homes with solar panels often sell faster. A Forbes report notes that solar-equipped homes sell 20% faster than those without. In a competitive market, that speed can make all the difference.

Energy Savings Appeal

Buyers love the idea of lower utility bills. A well-maintained solar system can slash monthly electricity costs, making the home more attractive.

Tax Incentives and Rebates

Many states offer property tax exemptions for solar installations. In fact, 29 states have some form of solar property tax relief, which can be a major selling point.

3. The Cons: When Solar Panels Might Hurt Your Sale

Leased vs. Owned Panels

One of the biggest pitfalls is leasing. If you don’t own your solar panels outright, the lease must be transferred to the new owner—or bought out. This can complicate the sale and deter buyers.

Aesthetic Concerns

Not everyone loves the look of solar panels. Some buyers may see them as an eyesore, especially if the installation is bulky or outdated.

Maintenance and Repairs

Buyers may worry about the cost of maintaining or replacing solar equipment. If the system is older or not under warranty, it could be seen as a liability.

Financing Confusion

Solar financing can be complex. Buyers unfamiliar with solar loans or power purchase agreements (PPAs) might be hesitant to take on the responsibility.

4. Factors That Influence Solar’s Impact on Home Value

Location, Location, Location

In sunny states like California, Arizona, and Florida, solar panels are almost expected. In less sunny or less eco-conscious regions, the value boost might be smaller.

Electricity Rates

Areas with high electricity costs see greater benefits from solar, making homes with panels more desirable.

System Size and Age

A newer, larger system in good condition will add more value than an older, smaller one. Buyers want efficiency and longevity.

Ownership Status

Owned systems are far more attractive than leased ones. If you’re considering solar, buying the system outright is usually the best move for resale value.

5. Real Estate Agent Insights: What the Pros Say

Many real estate agents agree that solar panels can be a strong selling point—if marketed correctly. Here’s what they recommend:

- Highlight the Savings: Show potential buyers past utility bills to demonstrate cost reductions.

- Provide Documentation: Include warranties, maintenance records, and system specs in your listing.

- Educate Buyers: Not everyone understands solar. Be ready to explain how the system works and what benefits it offers.

6. Case Studies: Real Homes, Real Results

Case Study 1: Phoenix, AZ

A 4-bedroom home with a 7kW solar system sold for $35,000 more than comparable homes without solar. The seller owned the system outright and provided detailed energy savings data.

Case Study 2: Columbus, OH

A home with leased panels sat on the market for 90 days before selling at a discount. Buyers were hesitant due to the lease transfer process.

Case Study 3: San Diego, CA

A modern home with a sleek, integrated solar roof sold in just 5 days—20% above asking price. The system was new, owned, and under warranty.

7. Tips for Maximizing Solar Value When Selling

- Own Your System: If possible, avoid leasing. Owned systems are simpler to transfer and more appealing.

- Keep It Maintained: Clean panels and up-to-date inverters show buyers the system is in good shape.

- Market the Benefits: Use your listing to highlight energy savings, tax incentives, and environmental impact.

- Work with a Solar-Savvy Agent: Choose a real estate agent who understands solar and can communicate its value effectively.

8. The Future of Solar in Real Estate

As solar technology improves and becomes more affordable, its role in real estate will only grow. Innovations like solar shingles, battery storage, and smart home integration are making solar even more attractive to buyers.

In the next few years, we can expect:

- More solar-friendly mortgage options

- Increased demand for net-zero homes

- Higher resale premiums for solar-equipped properties

Conclusion: So, Do Solar Panels Help or Hurt Your Home Sale?

In most cases, solar panels help—but only if they’re installed, maintained, and marketed properly. They can boost your home’s value, attract eco-conscious buyers, and speed up the sale process. However, pitfalls like leasing complications or poor system condition can hurt your chances.

If you’re thinking about selling your home and you have solar—or are considering installing it—make sure you understand the full picture. The right approach can turn your solar investment into a major selling advantage.

Are you planning to sell your home and wondering how solar panels will impact your sale? I can help you navigate the process, evaluate your system’s value, and market your home to the right buyers. Let’s connect and make your solar-powered sale a success!

#solarhomes, #realestate2025, #homesellingtips, #solarpanels, #greenhomes, #energyefficienthomes, #sustainableliving, #homevalue, #ecofriendlyhomes, #solarinvestment, #realestatemarketing, #homeupgrades, #sellmyhome, #solarbenefits, #propertyvalue

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

The second map shows that, over a roughly 30-year span, home prices appreciated by an average of more than 320% nationally.

The second map shows that, over a roughly 30-year span, home prices appreciated by an average of more than 320% nationally.

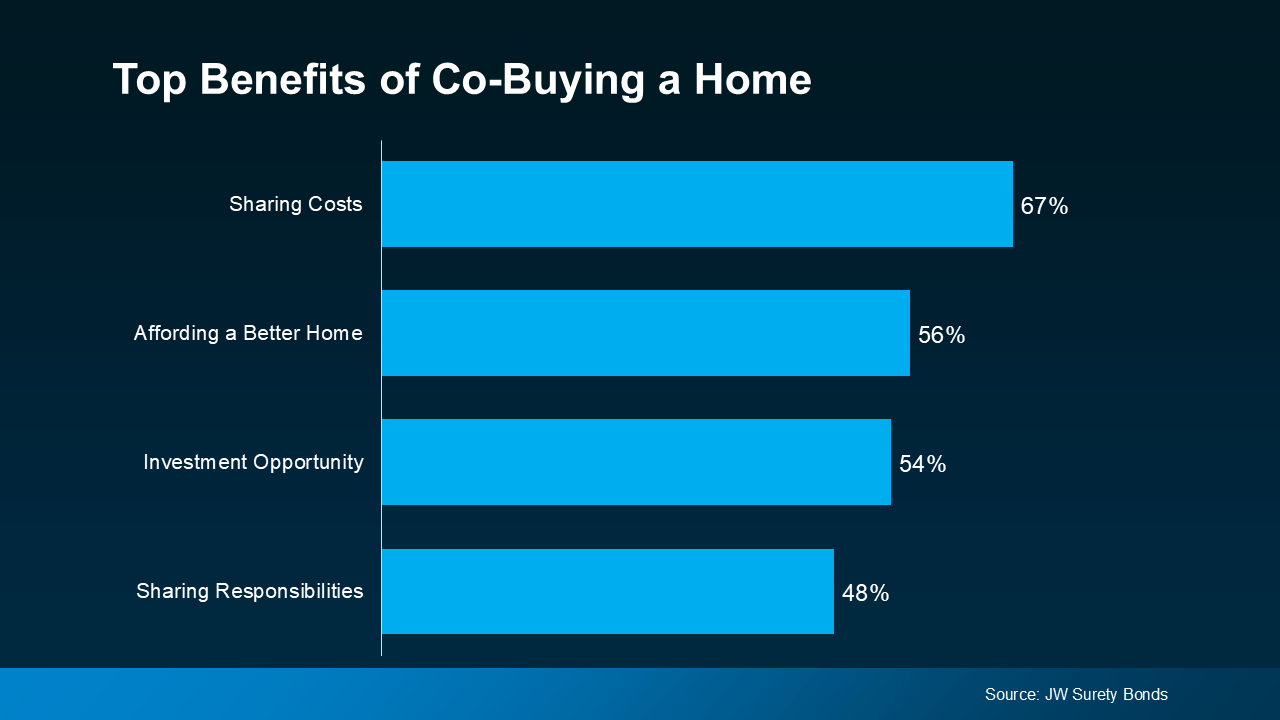

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.