What Happens After You Make an Offer on a Home? A Step-by-Step Guide for Buyers

Making an offer on a home is a thrilling milestone in your real estate journey. Whether you’re a first-time buyer or a seasoned investor, the moment you submit that offer is when things start to get real. But what happens next? 🤔

In this comprehensive guide, we’ll walk you through everything that happens after you make an offer on a home—from negotiations to closing day. Understanding each step will help you feel confident, informed, and ready to move forward.

📑 Step 1: Offer Submission

Once you’ve found the perfect home, your real estate agent will help you prepare and submit a formal offer. This includes:

- Purchase price 💰

- Contingencies (financing, inspection, appraisal)

- Earnest money deposit

- Closing date

- Any special requests or inclusions

Your agent will present this offer to the seller’s agent, and the waiting game begins.

🤝 Step 2: Seller Response

The seller can respond in one of three ways:

- Accept the offer 🎉

- Reject the offer ❌

- Counter the offer 🔁

If they accept, congratulations—you’re under contract! If they counter, negotiations begin. Your agent will guide you through this process to ensure your interests are protected.

📋 Step 3: Offer Acceptance and Contract Signing

Once both parties agree on the terms, the offer becomes a binding contract. This is known as being “under contract” or “pending.” At this point:

- The earnest money is deposited into an escrow account.

- The clock starts ticking on your contingencies.

- You’ll begin working with your lender to finalize your mortgage.

🕵️ Step 4: Home Inspection

The home inspection is one of the most critical steps. A licensed inspector will evaluate the property’s condition, including:

- Roof and foundation

- Plumbing and electrical systems

- HVAC

- Appliances

- Structural integrity

If issues are found, you can negotiate repairs, request credits, or even walk away if the problems are severe.

🧾 Step 5: Appraisal

Your lender will order an appraisal to determine the home’s market value. This protects both you and the lender from overpaying.

- If the appraisal matches or exceeds the offer price, you’re good to go.

- If it comes in low, you may need to renegotiate the price or bring additional funds to the table.

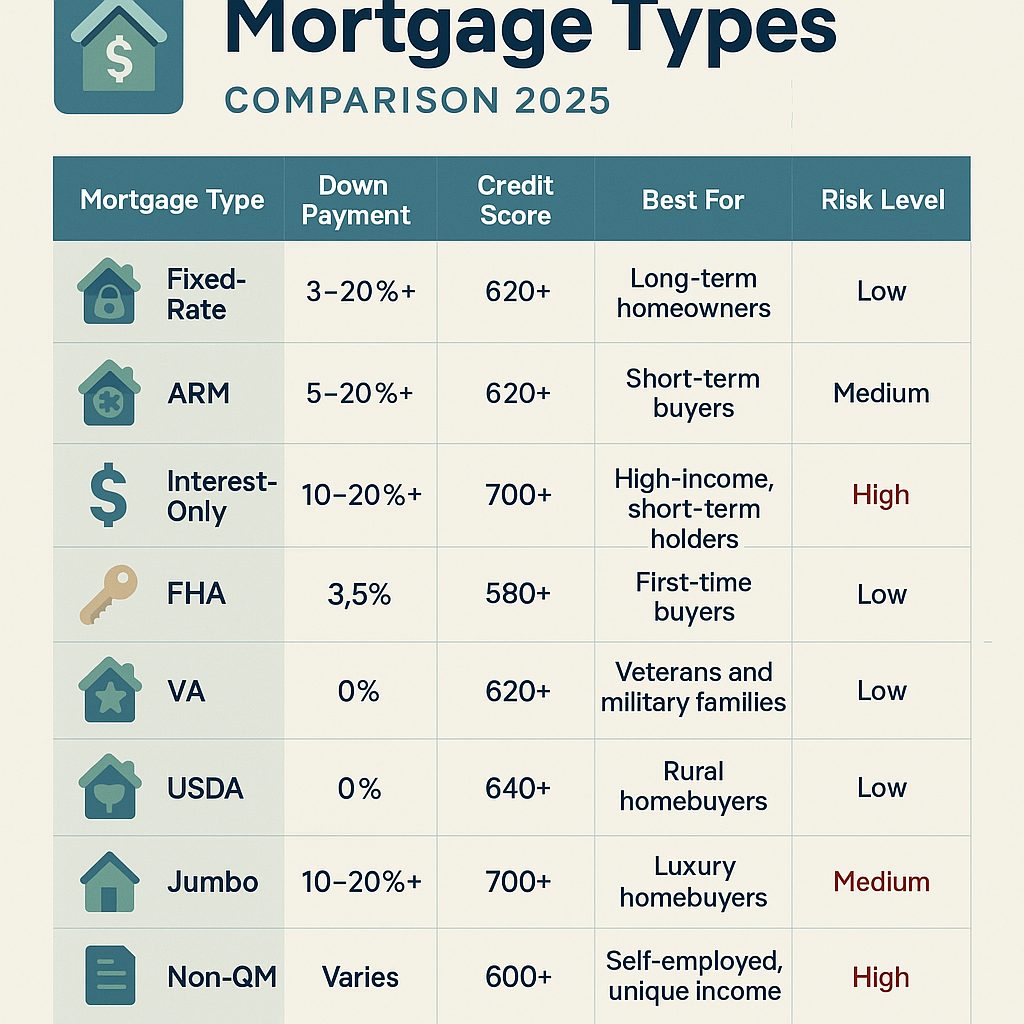

💼 Step 6: Finalizing Your Mortgage

During this phase, your lender will:

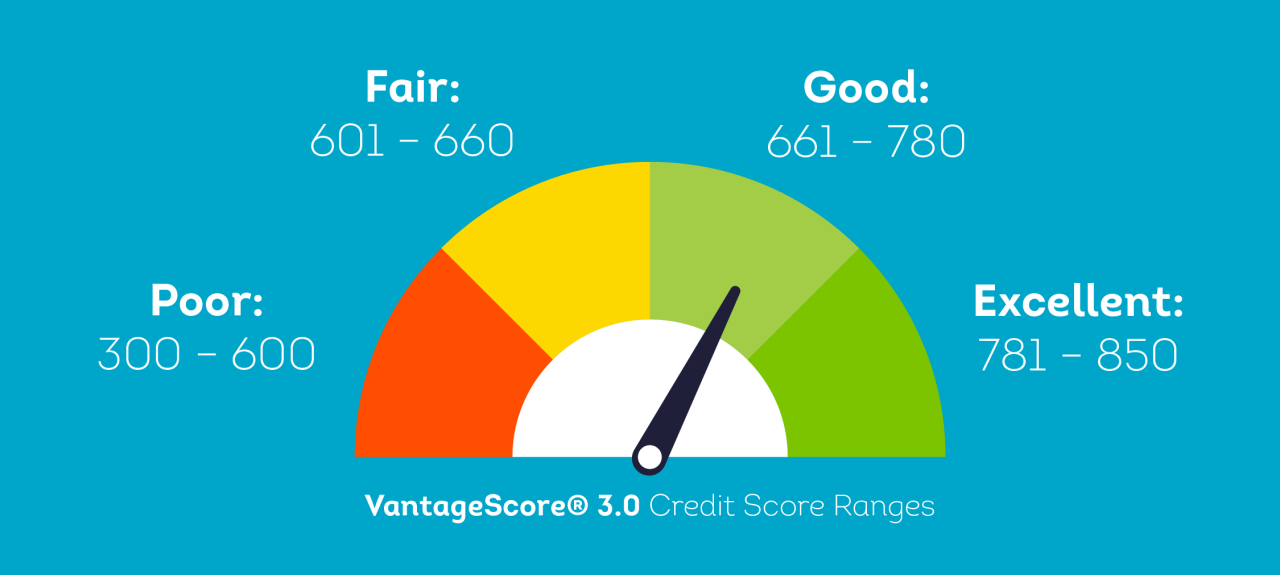

- Verify your financial documents

- Conduct a credit check

- Review the appraisal and inspection reports

- Issue a loan commitment

Be prepared to provide pay stubs, bank statements, tax returns, and other documentation.

🧑⚖️ Step 7: Title Search and Insurance

A title company will conduct a search to ensure there are no legal issues with the property, such as:

- Liens

- Disputes

- Unpaid taxes

You’ll also purchase title insurance to protect against future claims.

📝 Step 8: Contingency Removal

Once inspections, appraisals, and financing are complete, you’ll begin removing contingencies. This means:

- You’re committing to the purchase

- You’re ready to move toward closing

Your agent will help you navigate this process and ensure all deadlines are met.

📦 Step 9: Final Walkthrough

Typically conducted 24–48 hours before closing, the final walkthrough ensures:

- Repairs have been completed

- The home is in the agreed-upon condition

- Nothing has changed since your last visit

This is your last chance to raise concerns before signing the dotted line.

🖊️ Step 10: Closing Day

Closing day is when ownership officially transfers. You’ll:

- Sign all legal documents

- Pay closing costs

- Receive the keys 🔑

Your agent, lender, and title company will be present to guide you through the process.

🥳 Step 11: Welcome Home!

Congratulations—you’re now a homeowner! 🎉 Time to celebrate, move in, and make your new house a home.

🛠️ Bonus Tips for a Smooth Post-Offer Experience

Here are some expert tips to keep things running smoothly:

- Stay organized: Keep all documents in one place.

- Communicate regularly: Stay in touch with your agent and lender.

- Be responsive: Quick replies help avoid delays.

- Don’t make big purchases: Avoid changing your financial situation before closing.

- Ask questions: Your agent is there to help!

📣 Ready to Make Your Move?

If you’re thinking about buying a home or have questions about the process, I’m here to help! 🧭

Contact Mike McEntush, your trusted Cincinnati REALTOR®, for expert guidance every step of the way.

Let’s make your homeownership dreams a reality! 🏡✨

Making an offer on a home is just the beginning of an exciting journey. From inspections to closing day, each step is crucial to ensuring a smooth and successful transaction. With the right REALTOR® by your side, you’ll navigate the process with confidence and ease.

Whether you’re buying your first home or your fifth, understanding what happens after you make an offer empowers you to make smart decisions and avoid surprises.

So take a deep breath, trust the process, and get ready to unlock the door to your future! 🚪🔑

#realestate, #homebuying, #househunting, #realtorlife, #firsttimehomebuyer, #realestatetips, #closingday, #homeownership, #propertypurchase, #realestateagent, #homesweethome, #buyingahome, #realestateguide, #cincinnatirealestate, #mikeyourrealtor

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link