🏡 The Ultimate Guide to Mortgage Types in 2025: Pros, Cons & How to Choose the Right One

Buying a home is one of the biggest financial decisions you’ll ever make—and choosing the right mortgage can make or break your experience. With interest rates fluctuating and new loan products emerging, understanding your options in 2025 is more important than ever.

In this guide, we’ll explore the most common mortgage types, their advantages and disadvantages, and how to decide which one fits your financial goals. Whether you’re a first-time buyer, a military veteran, or a seasoned investor, this post is for you!

🔍 Why Mortgage Type Matters

Your mortgage type affects:

- Your monthly payments

- How much interest you’ll pay over time

- Your eligibility based on credit and income

- Your financial flexibility in the future

Let’s dive into the most popular mortgage types in 2025 and break down the pros and cons of each.

🧱 1. Fixed-Rate Mortgage (FRM)

✅ Pros:

- Predictable payments: Your interest rate stays the same for the life of the loan.

- Great for long-term planning: Ideal if you plan to stay in your home for 10+ years.

- Protection from rate hikes: No surprises if market rates rise.

❌ Cons:

- Higher initial rates: Compared to ARMs, fixed rates start higher.

- Less flexibility: If rates drop, you’ll need to refinance to benefit.

Best For:

- Buyers who value stability and plan to stay put.

🔗 Learn more about fixed-rate mortgages

🔄 2. Adjustable-Rate Mortgage (ARM)

✅ Pros:

- Lower initial rates: Great for short-term savings.

- Potential to save: If rates stay low, you could pay less over time.

❌ Cons:

- Uncertainty: Rates can rise, increasing your monthly payment.

- Complex terms: Caps, margins, and indexes can be confusing.

Best For:

- Buyers who plan to move or refinance within a few years.

🔗 Explore how ARMs work

🧮 3. Interest-Only Mortgage

✅ Pros:

- Lower payments initially: You only pay interest for a set period.

- Cash flow flexibility: Ideal if your income is expected to rise.

❌ Cons:

- No equity build-up: You’re not paying down the principal.

- Payment shock: Payments jump when the interest-only period ends.

Best For:

- Investors or high-income earners with variable income.

🔗 Interest-only mortgage explained

🏛️ 4. FHA Loan (Federal Housing Administration)

✅ Pros:

- Low down payment: As little as 3.5%.

- Lenient credit requirements: Great for first-time buyers.

❌ Cons:

- Mortgage insurance required: Adds to monthly costs.

- Loan limits: May not cover high-cost areas.

Best For:

- First-time buyers or those with lower credit scores.

🔗 FHA loan eligibility and benefits

🎖️ 5. VA Loan (Veterans Affairs)

✅ Pros:

- No down payment required.

- No private mortgage insurance (PMI).

- Competitive interest rates.

❌ Cons:

- Eligibility restricted: Only for veterans, active-duty service members, and some spouses.

- Funding fee: May apply upfront.

Best For:

- Eligible military personnel and veterans.

🔗 Check VA loan eligibility

💼 6. USDA Loan (U.S. Department of Agriculture)

✅ Pros:

- Zero down payment.

- Low interest rates.

- Flexible credit guidelines.

❌ Cons:

- Location restrictions: Only for rural and some suburban areas.

- Income limits: Based on household size and location.

Best For:

- Buyers in rural areas with moderate income.

🔗 Find eligible USDA areas

💰 7. Jumbo Loan

✅ Pros:

- Higher loan limits: For luxury or high-cost homes.

- Flexible terms: Fixed or adjustable options.

❌ Cons:

- Stricter requirements: Higher credit scores and larger down payments.

- Higher interest rates: Compared to conforming loans.

Best For:

- Buyers purchasing high-value properties.

🔗 Jumbo loan basics

🧾 8. Non-QM Loans (Non-Qualified Mortgages)

✅ Pros:

- Flexible documentation: Great for self-employed or gig workers.

- Alternative income verification.

❌ Cons:

- Higher interest rates.

- Less regulation: May carry more risk.

Best For:

- Buyers with non-traditional income or unique financial situations.

🔗 What is a Non-QM loan?

🧠 How to Choose the Right Mortgage Type

Here are a few questions to ask yourself:

- How long do I plan to stay in the home?

- What’s my credit score and income stability?

- Do I have savings for a down payment?

- Am I eligible for government-backed loans?

- Do I prefer predictable payments or initial savings?

Use tools like mortgage calculators and speak with a licensed mortgage advisor to compare options.

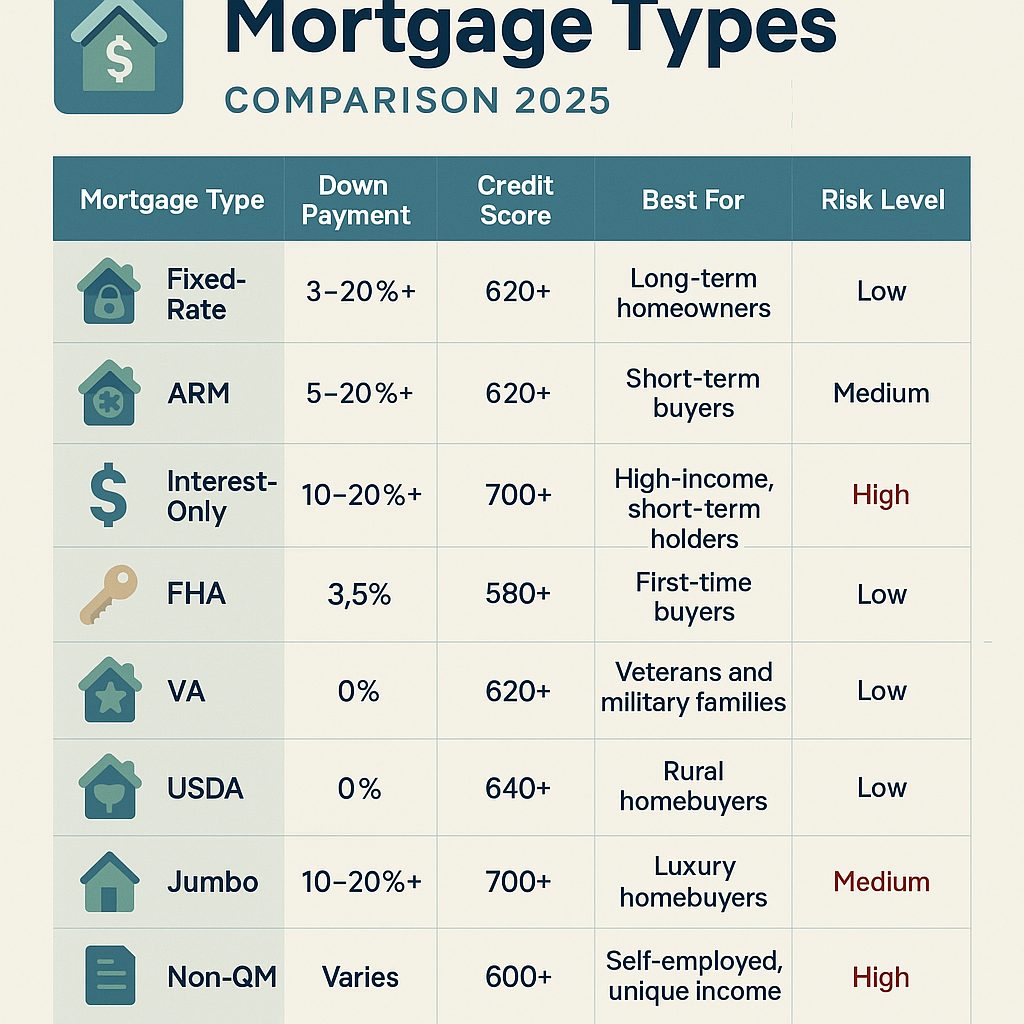

📊 Mortgage Comparison Table

| Mortgage Type | Down Payment | Credit Score | Best For | Risk Level |

|---|---|---|---|---|

| Fixed-Rate | 3–20%+ | 620+ | Long-term homeowners | Low |

| ARM | 5–20%+ | 620+ | Short-term buyers | Medium |

| Interest-Only | 10–20%+ | 700+ | High-income, short-term holders | High |

| FHA | 3.5% | 580+ | First-time buyers | Low |

| VA | 0% | 620+ | Veterans and military families | Low |

| USDA | 0% | 640+ | Rural homebuyers | Low |

| Jumbo | 10–20%+ | 700+ | Luxury homebuyers | Medium |

| Non-QM | Varies | 600+ | Self-employed, unique income | High |

📣 Ready to Take the Next Step?

Whether you’re buying your first home or upgrading to your dream property, choosing the right mortgage is key 🔑. I’m here to help you navigate the process with confidence and clarity.

👉 Let’s talk about your mortgage goals today!

#realestate, #mortgage, #homebuying, #firsttimehomebuyer, #realestateinvesting, #mortgagetips, #homeownership, #realestategoals, #propertyinvestment, #househunting, #realtorlife, #financialfreedom, #realestatemarket, #dreamhome, #mortgagerates

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link