🏡 How to Improve Your Credit Score Before Buying a Home 🏡

Buying a home is a significant milestone in anyone’s life. However, before you can get the keys to your dream home, you need to ensure that your credit score is in top shape. A good credit score can save you thousands of dollars in interest over the life of your mortgage. Here’s how you can improve your credit score before buying a home.

Understanding Credit Scores 📊

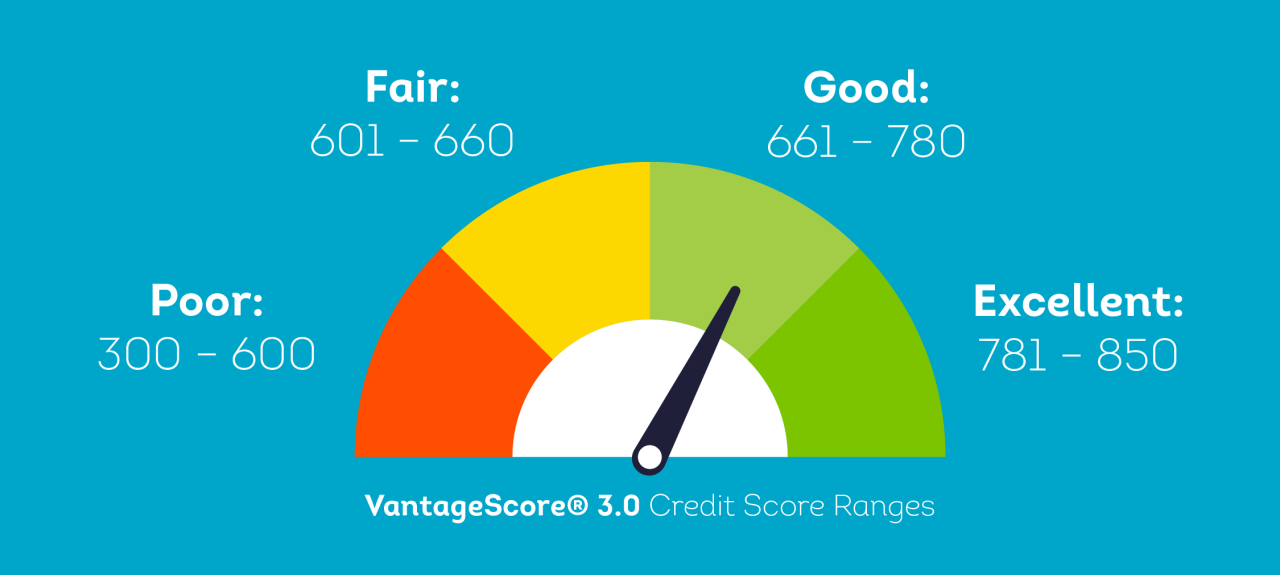

Your credit score is a three-digit number that lenders use to determine your creditworthiness. It ranges from 300 to 850, with higher scores indicating better credit. Here are the factors that influence your credit score:

- Payment History (35%): Your record of on-time payments.

- Credit Utilization (30%): The amount of credit you’re using compared to your credit limits.

- Length of Credit History (15%): How long you’ve had credit accounts.

- Credit Mix (10%): The variety of credit accounts you have.

- New Credit (10%): Recent credit inquiries and newly opened accounts.

Steps to Improve Your Credit Score 🚀

- Check Your Credit Report: Obtain a free copy of your credit report from the major credit bureaus (Equifax, Experian, and TransUnion). Review it for errors and dispute any inaccuracies.

- Pay Your Bills on Time: Set up automatic payments or reminders to ensure you never miss a payment.

- Reduce Credit Card Balances: Aim to keep your credit utilization below 30%. Pay down high balances and avoid maxing out your cards.

- Avoid Opening New Credit Accounts: Each new account results in a hard inquiry, which can temporarily lower your score.

- Keep Old Accounts Open: The length of your credit history matters. Keep older accounts open to maintain a longer average credit history.

- Diversify Your Credit Mix: Having a mix of credit types (credit cards, installment loans, etc.) can positively impact your score.

- Negotiate with Creditors: If you’re struggling to make payments, contact your creditors to negotiate a payment plan.

- Become an Authorized User: Ask a family member with good credit to add you as an authorized user on their credit card.

- Use a Secured Credit Card: If you have poor credit, a secured credit card can help you rebuild your score.

- Monitor Your Credit Regularly: Use credit monitoring services to keep an eye on your score and receive alerts for any changes.

Real-World Examples 🌟

- Case Study 1: Jane improved her credit score by 100 points in six months by paying down her credit card balances and disputing an error on her credit report.

- Case Study 2: John raised his score by 50 points by becoming an authorized user on his sister’s credit card and making timely payments.

Conclusion 🏁

Improving your credit score before buying a home is crucial for securing the best mortgage rates. By following these steps, you can boost your score and save money in the long run. Remember, a higher credit score not only helps you get approved for a mortgage but also opens doors to better financial opportunities.

#RealEstate, #HomeBuying, #CreditScore, #MortgageTips, #HomeOwnership, #FinancialHealth, #CreditRepair, #DreamHome, #HouseHunting, #FirstTimeHomeBuyer

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link